The banking and financial services sector is the backbone of any nation's economy. This sector demands maintaining high customer satisfaction, which is possible with compliant, skilled, and industry-focused employees. These qualities can be enhanced with banking and finance training for employees.

Traditional training methods in banking, such as workshops, classroom instruction, or seminars, are often time-consuming, expensive, and difficult to scale across multiple branches. This is where a Learning Management System (LMS) for banking comes in, providing an efficient, cost-effective, and scalable solution.

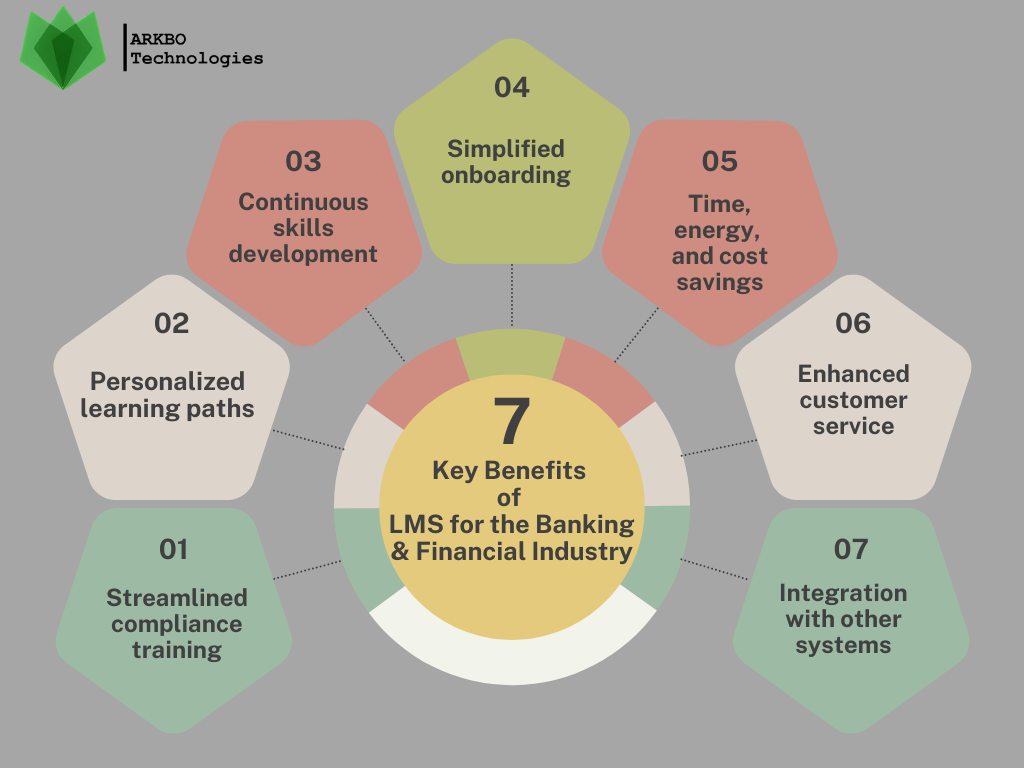

In this blog, we will explore the benefits of LMS in banking and financial institutions and why it is increasingly adopted by banks in Nepal and globally.

Let’s dive into the advantages of opting for LMS over traditional mediums for training activities in financial institutions.

Streamlined Compliance Training

Compliance training for financial institutions is the structured education and training given to employees to ensure their understanding and adherence to the complex regulations and laws governing the banking industry. It covers critical areas such as anti-money laundering (AML), know your customer (KYC) policies, data protection, cybersecurity, fraud prevention, ethics, and more.

A centralized LMS for financial institutions ensures consistent and standardized training across all branches. This reduces the risk of human error and regulatory penalties, while also lowering hidden costs associated with inefficient traditional training.

Personalized Learning Paths

In banks, different roles like tellers, loan officers, and relationship managers require distinct knowledge and competencies. Also, each employee has their own way of acquiring knowledge. An LMS for banking can have tailored training programs considering each employee’s unique learning path, role, and skill level.

Training and learning in the way they like enhances knowledge retention, as employees are more likely to remember information that applies to their responsibilities. A personalized learning path approach helps banks build a more competent and confident workforce.

Continuous Skills Development

The bank’s financial products, services, and technologies are ever evolving, which means employees need to make continuous skills development. Without such development, banks can encounter more errors and degrade service quality.

With an LMS system, employees can receive continuous training, ensuring the workforce remains competitive and adaptable to market changes. Other than that, such skill development contributes to professional growth and motivates employees to stay with the organization. Moreover, 94% of employees are more likely to stay at a company longer if it invests in their learning and development ( LinkedIn Learning Report 2022).

Simplified Onboarding Process

Traditional onboarding can be time-consuming and inconsistent, particularly in large banks with multiple branches. But with an LMS for financial institutions, employees can learn at their own pace while ensuring they cover all mandatory courses. This reduces the time and cost associated with in-person training sessions. Consistent onboarding also helps new employees become productive faster and reduces early mistakes.

For details, you can read our blog on How to use LMS for onboarding new employees? A step-by-step-guide

Time, Energy, and Costs are Saved

Traditional training methods often require physical classrooms, printed materials, and external trainers. To attend such training, travel and accommodation expenses also show up. Eventually, these costs add up quickly, especially for large banks with widespread operations.

By shifting to digital training with LMS, banks can deliver the same high-quality learning content online to all employees without any constraints. LMS-led training can be scaled across multiple branches at once, saving both time and money while ensuring consistency in learning outcomes. In fact, companies with comprehensive LMS-based training programs see up to 218% higher revenue and 24% greater profit margins (Hurix Digital, 2025).

Enhanced Customer Service

Just like any service-providing industry, banks and financial institutions prioritize customer satisfaction. Thus, training on customer handling and banking products is always a top priority.

With an LMS system, employees can take training or assessment to answer customers' questions accurately, suggest suitable products, and resolve issues efficiently. Skilled, efficient, and confident employees can offer better, consistent, and positive customer experiences.

Integration with Other Systems

Modern learning platforms can integrate with HR, payroll, and performance management systems, streamlining administrative tasks. In LMS for financial institutions, training records are automatically updated, saving time and reducing errors. It also aligns employee learning with performance evaluations and career development plans. By connecting systems, banks can track compliance, identify training needs, and plan promotions or role changes.

Once you decide to implement an LMS to improve the overall skills of your workforce, it is time to figure out what qualities to look for. Here are some essential features you need to consider:

Security: Protects the bank’s sensitive data and ensures regulatory compliance.

Gamification: Enhances engagement and allows tracking of learning outcomes.

Integration: Streamlines workflows by connecting with HR and banking software.

Support: Reduces downtime with 24/7 technical assistance.

Scalability: Supports growth across branches and increasing employee numbers.

Check out more features in our blog, 10 Key Features of Learning Management System (LMS).

Why choose ARKBO LMS for bank-related training and learning?

ARKBO LMS is a popular LMS in Nepal, known for its features supporting corporate training and learning. So far, this platform has been chosen by more than 10+ banks in Nepal, reflecting the trust in the modern learning system for employees. Overall, ARKBO LMS helps banks train staff effectively while saving time and operational costs.

Via ARKBO LMS, financial institutions can get the following features:

Centralized compliance training ensures that employees follow AML, KYC, and data protection rules.

Personalized learning paths for role-specific courses. In fact, it offers inclusive and equitable training opportunities so that differently abled employees can learn in their own way.

Continuous skills development, which keeps staff updated on financial products and technology.

Flexible & accessible learning which allows employees to train anytime, anywhere.

Real-time assessments boost engagement and retention.

Employees in the banking and financial industry are required to undergo training in order to

maintain and improve compliance and be able to meet customer expectations. The traditional training can be costly, time-consuming, and difficult to scale across multiple branches. These issues can be easily solved by a Learning Management System (LMS). With custom and learning flexibility, employees' performance improves, operational costs reduce, and better customer service is offered while staying compliant.

Among various LMS in Nepal, ARKBO LMS is the best for a financial institution. This platform is trusted by leading banks in Nepal, enabling them to build a skilled and future-ready workforce.

Take the next step to empower your workforce with ARKBO LMS. Book a Demo today!